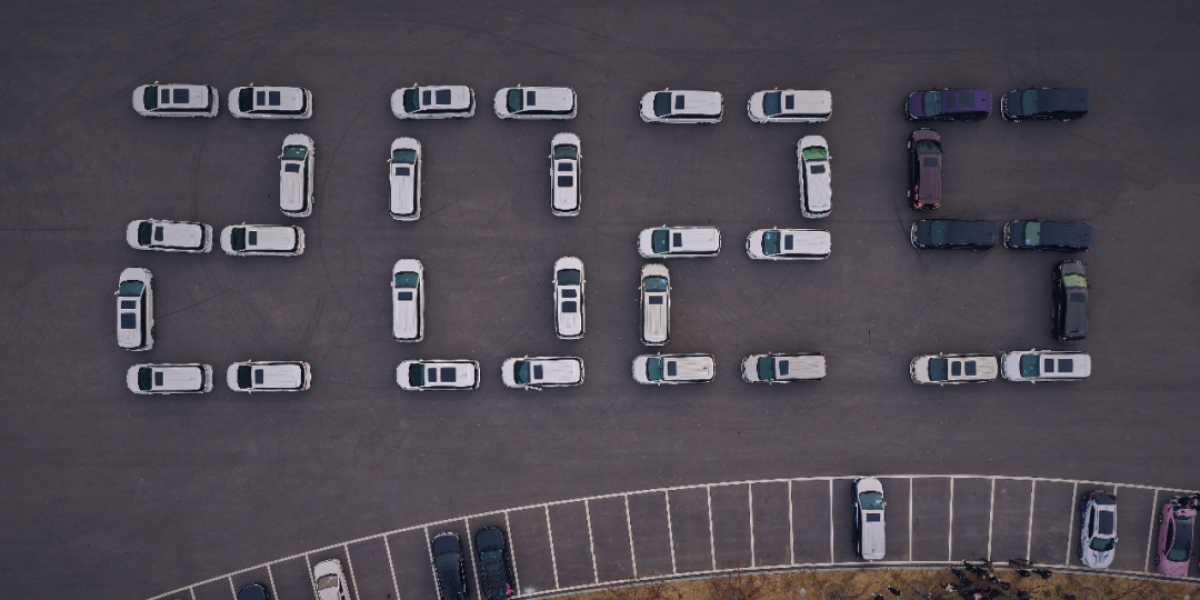

As 2025 draws to a close, China’s automotive industry stands at a pivotal moment, having undergone one of the most profound transformations in its history. Over the past year, rules were redefined, market structures reshaped, technologies pushed closer to mass adoption, and Chinese carmakers accelerated their expansion overseas. Alongside landmark breakthroughs came growing pains and painful adjustments. For many companies, 2025 resembled a coming-of-age test — one that challenged not only business survival, but the direction of the entire industry. Here are ten defining events that helped shape China’s auto market in 2025 — offering not just a review of the year gone by, but clues to what lies ahead.

1. A Line Drawn Against “Cut-Throat Competition”

In October 2025, China’s new-energy vehicle (NEV) market crossed a historic threshold. According to data from the China Association of Automobile Manufacturers (CAAM), monthly NEV penetration rose above 50% for the first time, reaching 51.6%. In practical terms, one in every two new cars sold was electric or plug-in hybrid — a sign that NEVs had firmly entered the mainstream.

The momentum continued. By November, penetration climbed to 59.3%.

Yet rapid expansion came at a cost. Fierce price wars — often described domestically as “involutionary competition” — eroded profit margins, squeezed research budgets and placed heavy strain on supply chains. In the first half of the year, more than half of China’s auto dealers were operating at a loss.

In response, the State Administration for Market Regulation released a draft Compliance Guidelines on Pricing Practices in the Automotive Industry in December. The document explicitly bans selling below cost when inventories are not excessive, mandates transparent pricing, and standardises delivery processes — marking the first clear regulatory red line against destructive price competition.

2. A Wave of New Regulations

Throughout 2025, China rolled out a dense package of new automotive regulations, with a strong focus on safety and intelligent driving.

On the safety front, new national standards for power batteries — GB38031-2025 — were issued in April. They introduced quantified safety benchmarks, including a requirement that no open flames occur within two hours after a single-cell thermal runaway. The rules will take effect in July 2026. At the same time, safety standards for components such as door handles were tightened to improve usability in emergency scenarios.

In intelligent driving, regulation accelerated after a fatal accident involving Xiaomi’s SU7 in March. Authorities moved quickly to curb misleading marketing, banning terms such as “autonomous driving” and requiring the use of “driver assistance” instead. Products marketed as “driver-assist hacks” were removed from online platforms.

Meanwhile, progress continued towards Level-3 autonomous driving. Beijing became the first city to clarify accident liability rules in April, and in December the Ministry of Industry and Information Technology approved two models for L3 pilot operations on designated roads — under strict speed and scenario limitations. It marked the first tangible step towards commercial deployment.

3. The Double-Edged Sword of Trade-In Subsidies

Government trade-in incentives proved to be the single most important driver of car sales in 2025. From January to November, more than 11.2 million vehicles were replaced under the programme — accounting for roughly one-third of total sales and stabilising the overall market.

But alongside the surge emerged a controversial phenomenon: so-called “zero-kilometre used cars”. These are vehicles that have been registered and counted as sold, yet never delivered to real consumers and show little or no mileage.

The practice attracted regulatory attention. The Ministry of Commerce convened automakers and industry groups to discuss corrective measures, while the MIIT pledged stronger action against disorderly competition.

4. Exports Surge to New Highs

China’s car exports soared in 2025, with full-year shipments expected to exceed seven million units — securing China’s position as the world’s largest auto exporter for a third consecutive year. The figure is projected to be nearly double that of Japan.

CAAM data shows that between January and November, exports reached 6.34 million vehicles, up 18.7% year-on-year.

NEVs were the main growth engine. In November alone, NEV exports hit 300,000 units, a year-on-year surge of 260.8%, pushing their share of total exports beyond 40% for the first time. Over the first 11 months, cumulative NEV exports reached 2.32 million units — more than doubling from a year earlier. BYD and Chery led the charge.

5. Semi-Solid-State Batteries Enter the Mass Market

2025 marked a turning point for semi-solid-state batteries, as the technology moved from laboratories into commercial production.

SAIC-owned MG launched the MG4 Semi-Solid Edition, bringing the technology into the RMB 100,000 ($14,000) price segment. Developed jointly by SAIC and QingTao Energy, the battery reduces liquid electrolyte content to just 5%, significantly improving safety performance in puncture and compression tests.

Other manufacturers, including Nio and IM Motors, also began offering semi-solid-state batteries in premium trims, accelerating industry adoption.

6. An Industry-Wide Consolidation Wave

Unlike previous years, when carmakers raced to launch sub-brands, 2025 saw many companies turn inward, consolidating resources amid intense competition.

Geely provided the most notable example. In December, it completed the privatisation and merger of its premium EV brand Zeekr, making it a wholly owned subsidiary — a key step in its “One Geely” strategy.

GAC Group launched internal restructuring under its “Panyu Action Plan”, while JAC Motors and others pursued similar integration of marketing and operational systems.

At the top level, China’s industry structure also shifted. In July, China Changan Automobile Group was formally established in Chongqing with State Council approval. As a new centrally owned enterprise, it now stands alongside FAW and Dongfeng, forming a three-pillar structure among state-owned automotive groups.

7. A Landmark Year for IPOs

2025 became a banner year for automotive IPOs, particularly in Hong Kong.

Battery giant CATL listed in May, raising the largest H-share offering in nearly four years. Chery Automobile finally went public in September after a 21-year wait, while Seres raised HK$14 billion in November — the largest auto IPO of the year.

Autonomous driving firms Pony.ai and WeRide, lidar maker Hesai, and cockpit technology supplier Botai also debuted. By year-end, more companies — including Avatr and Voyah — were still lining up for listings.

8. Huawei’s Automotive “Circle” Expands

By 2025, Huawei’s Harmony Intelligent Mobility Alliance had grown into a five-brand ecosystem, partnering with Seres, Chery, BAIC, JAC and SAIC.

At the same time, a parallel cooperation route led by Huawei’s automotive unit gained traction. New brands emerged with GAC and SGMW, while Dongfeng is expected to follow suit.

Huawei’s automotive partnerships now span nearly all major Chinese auto groups, cementing its central role in the sector.

9. A 60-Day Payment Commitment

To address long-standing payment delays in the supply chain, 17 major automakers — including SAIC, Dongfeng, BYD, Geely, Li Auto and Xiaomi — pledged in June to settle supplier payments within 60 days.

In September, CAAM formalised the initiative, calling for vehicle acceptance within three working days and payment periods no longer than 60 calendar days, alongside one-year minimum contracts.

10. A Storm of Executive Shake-Ups

Finally, 2025 saw an unprecedented wave of leadership changes across the industry.

In just the first three weeks of September, 48 executive roles changed hands at 13 automakers, including 10 brand chiefs. The pace intensified in the fourth quarter, with data suggesting 327 executive changes across 29 companies between October and December — including six CEO replacements.

Taken together, these ten events reveal an industry at a critical crossroads — more regulated, more global, and more fiercely competitive than ever before. How Chinese automakers navigate the next phase may determine not just their own survival, but their standing in the global automotive order.